Strong Price Levels: How to Maximize Their Potential

The same system that helped me make decisions leading to 150%+ returns — now explained with real setups and clear rules.

Hey there! 🙌

Ever felt that confusion when the price just sits there… moving sideways, and you have no idea what the right move is — buy, sell, or hold?

This is exactly where most investors get it wrong.

They hope. They guess. They act on emotion.

👉 In this article, I’ll share a system and clear rules that make these situations much easier to handle. The same logic has helped me make decisions that led to returns of 150%, and it can help you too.

Today, we’re talking about strong and sensitive price levels:

How to identify them

How they help you make better, more confident decisions

And how to put them to work for you

The trickiest moments often come when the price is stuck in the middle of the chart.

Not at the top. Not at the bottom. Just moving sideways… with no obvious clue what to do.

That’s when the big questions arise:

Is this even a stock worth buying? And if so, when?

The stock is holding steady, having recently ranged, and its fundamentals look good — is this the right combination?

Or is this actually the place to lock in profits… or cut losses?

Today, we’ll talk about price levels that give you one simple line to decide:

Take profits, or wait for a breakout.

No guessing. No emotions.

✍️ Grab your notebook, and let’s dive in…

1. The more reversals, the better

One of my most reliable criteria for spotting a strong price zone is frequent reversals.

The more often the price has acted as both support and resistance in the same area, the more “familiar” and sensitive that zone becomes to investors.

It doesn’t matter whether the price level is one year old or twenty. Prices have a history. Investors have memory.

And you can see it all on the chart:

Where people sold for a profit.

Where they sold in panic and took a loss.

Where they bought and built new positions.

This collective memory stays in the price levels like footprints in the sand.

Every time the price returns to that zone, investors react — driven by emotion as much as numbers.

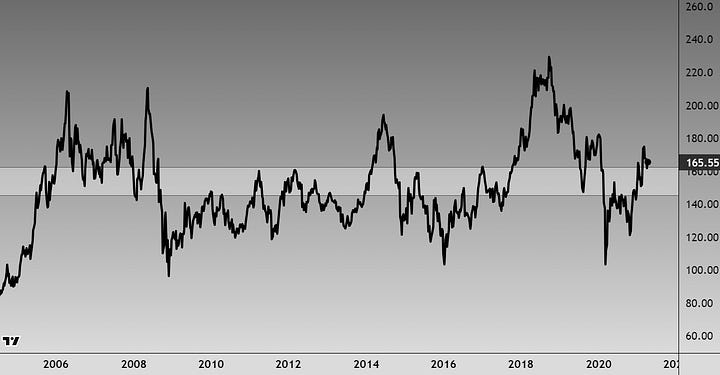

Case study: Equinor (OSL: EQNR)

Here’s one example I’ve mentioned before.

At the conference in 2021, I shared the idea fo EQNR. The pattern was crystal clear: multiple reversals. A well-defined price zone. The same logic is at work.

As the chart shows, around 150 NOK, there have been major price reactions — over and over again. Each time the stock enters this zone, something significant happens.

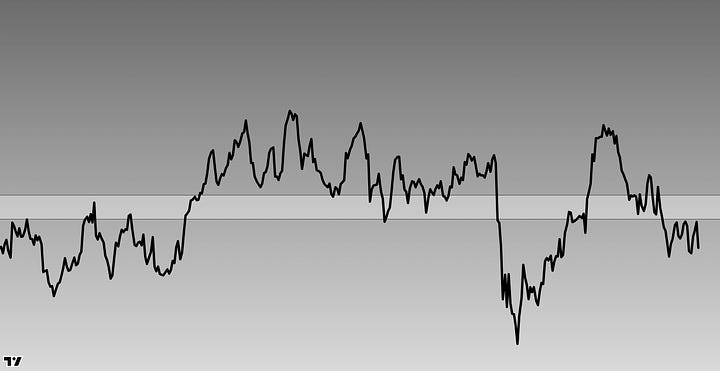

💡 And if it all looks too noisy on a candlestick chart, a line chart often helps…

It removes the distractions and makes the key turning points stand out clearly.

This idea is also available on TradingView, just in a slightly different format: HERE

The Rule

If you can’t identify these reversals clearly — if there are no obvious, repeated reactions — then the zone doesn’t exist. Not every stock forms such levels.

But the moment you can see it with your eyes, the level is real.

That’s one of the big advantages of technical analysis:

💡 What is clearly visible is strong!

If you have to dig for it…

… it’s probably weak and unreliable.

👉 This channel is for long-term investors who want to make more informed, consistent decisions by using even a bit of technical analysis to manage their capital wisely.

By joining, you’ll get:

1–2 analyses per week

Technically strong zones

Action plans and rules for every setup

In today’s article:

Examples across EQNR, AMD, TSM, VWS, LUV, TSLA

Clear guidance on profit-taking vs waiting for breakouts

Entry rules and methods for spotting strong zones

Subscribe to get instant access to the entire archive.

Case study: Advanced Micro Devices (AMD)

Back in February 2025

… on TradingView, I shared an idea for Advanced Micro Devices (AMD). One of the key criteria there was also a strong price level that the stock price kept moving toward.

Case study Taiwan Semiconductor (TSM)

Shared LIVE at the Investor Toomas Conference 2024 in Estonia

This chart is on the weekly timeframe, but the “pattern” and logic remain the same:

Major buying and selling moves have repeatedly started from this exact price level.

And even when there were only minor bounces or short pauses, those moments still added strength to the zone.

Case study: Vestas Wind System (VWS)

Mentioned at the Investor Toomas Conference 2024, in front of 1,000+ participants.

In the 200–220 DKK range, the price acted as support in 2020–21 (blue arrows).

At the end of 2021, the breakdown below this level flipped it into resistance.

When you move to a lower floor in a building, the floor above you becomes the ceiling. Financial markets work the same way — old support often turns into resistance once it breaks below.

How to Act When Price Reaches a Key Zone

Sometimes the price falls from above into a strong support zone (like AMD).

Sometimes it rallies hard from the lows into a major resistance zone (like VWS or TSM).

And sometimes the price is inside the zone itself (like EQNR).

But the real question is: How should you act? What’s the right approach in these situations?

Simple Rules

💡 If a strong zone has been identified and the price approaches it from below, rising into it, that level acts as resistance.

Your two main choices:

Wait for the breakout and act only after confirmation.

Take profits if you’re already in a position from much lower levels.

Remember: When the price reaches such a zone, something always happens.

Example: Vestas Wind Systems (VWS)

Here were the options:

Wait for the breakout before buying.

Or take profits if you entered lower, say around 140–150 DKK.

And if you’re somehow still holding a position from 2021, this might be the place to finally take a small loss. After all, your three-year-old investment thesis probably isn’t the same anymore — and these levels are often the best places to finally let them go…

Buying aggressively right into resistance? Not optimal.

Why assume that a level tested multiple times over two years will suddenly break this time?

You might hope.

You might guess.

But hope and guessing can be expensive.

The outcome for VWS:

Winners: Those who waited for the signal, held off until the breakout, or took profits in time — even taking a small loss can feel like winning when you look at this chart… right?

Losers: Those who rushed in before the breakout and guessed instead of waiting.

The lesson?

Patience pays. Rushing doesn’t.

You might think you’ll grab a few extra percentage points by buying early, but without waiting for confirmation that investors are actually willing to pay more. Sure, you’re invested, you can cheer for everyone… but you jumped in too soon, and now you’re stuck in a deep drawdown.

Example: TSM

We wait for the breakout.

Or, if you’re already in and want to reduce risk a bit, this is the perfect place to take some profits.

You can always buy back after the breakout, once investors have shown real buying interest and the stock price has proven its strength.

But don’t assume it will break through now… as you saw in the previous example, that assumption can be costly.

TSM a few moments later

This time the breakout came with a clear, strong weekly candle.

The weekly close was safely above the key price level, and from there, the move could finally begin.

👉 Today’s examples weren’t cherry-picked in hindsight by scrolling through charts looking for the perfect setups. Remember: 99% of my examples and explanations come from real-time situations — every chart was a genuine ‘today!’ moment when I shared it.

Same Entry Rules Apply

If you’ve seen a breakout, the same rules apply here as with all-time high breakouts. For reference, here’s the full article I shared a few weeks ago — definitely worth a look:

Simple entry explanations:

If the weekly (or monthly) close happens not too far above the level, you can enter right away.

You can wait for a retest:

But if the close happens too far above the level, it’s usually smarter to wait for a retest.

Example: EQNR

With Equinor, the same rule applied:

Take profits if you want.

Or wait for the breakout.

No guessing. No rushing. Let the market show its hand.

The outcome:

The breakout eventually came, and the stock moved up strongly after that.

Another case: Southwest Airlines (LUV)

Shared at the Investor Toomas Conference again:

A strong price level that has acted multiple times as both resistance and support.

Right now, the price is below that level, which means it’s resistance.

For that resistance to break, you need a clear signal from buyers, a real breakout.

Until then, we wait.

We don’t predict.

And What Happened?

The stock tried to break the level but got rejected hard, the door slammed shut quickly, and the stock hasn’t recovered since.

And those who tried to cheat?

They got another “forever hold” stock in their portfolio — just to remind them:

On financial markets, there’s no need to cheat.

No need to act on hope alone.

Strong volume is important!

Let’s add another crucial criterion that makes a price level truly “the right one” — even when there haven’t been many clear reversals in the past.

Take Tesla (TSLA) as an example:

Shared on TradingView in April 2024: HERE

As you can see, the big, obvious reversals have happened mostly at other price levels, not so much around my marked $150. There, we saw mostly small pauses and short pullbacks, but within those moves was one important element. Inside the circles…

The Power of the Breakout

That element was a big, powerful breakout. Strong candles.

To break through such a level, you need the masses to step in…

And that shows up in the size and volume of the candles. Big, clear candles that smash through the level with force.

If there have been many reversals, always check the strength of the breakout candles too.

Are they strong enough to punch through the level? That makes all the difference.

The moment the price starts to ‘walk’ on top of the level, moving sideways without conviction, it’s a clear sign the zone is losing strength.

The strength of the zone depends heavily on these strong, decisive breakout candles. If you haven’t seen them lately, the reliability of the zone decreases.

Key Takeaways

These kinds of “hidden zones” add a lot to structured decision-making:

Position sizing: Identify levels where you can add to positions, but only after the breakout.

New entries: Same logic, wait for the breakout, don’t assume anything in advance.

Profit-taking: If you’re already in a position and price enters this zone, there’s a high chance of a correction or sideways movement. Your capital sits idle.

Sometimes a line chart helps create a clearer picture when things get messy.

Clear Rules

The more reversals, the better.

The clearer they are, the better.

Round numbers give the level psychological weight:

AMD — $100

VWS — $200

EQNR — $150

LUV — $50

TSLA — $150

Most reversals happen near these numbers.

Historically strong breakouts with big candles make the zone more reliable.

If price just “walks” through the level without clear breakout candles, the strength weakens.

Once again: volume and candle strength are key — breakouts with heavy participation send a far stronger signal.

You don’t need to guess.

Let the market prove itself.

Don’t front-run it — I hope the LUV and VWS examples made that crystal clear!

Thank you for reading!

❤️ If you found this guide helpful, give it a “like” so I know these breakdowns bring you value.

💬 Got a question or need clarity on a chart? Drop it in the comments, I’m happy to help.

📢 And if you know someone who’d benefit from this, feel free to share it with them.

Stay sharp,

Vaido Veek